Understanding Forex Trading Profit: Strategies for Success

Forex trading has gained immense popularity over the years as investors seek to profit from the fluctuations in currency prices. While many are drawn to the potential for high returns, it is essential to understand the nuances of Forex trading profit, which involves both strategies for success and awareness of the associated risks. In this guide, we will delve into various aspects of Forex trading, including effective methods to maximize profits and common pitfalls to avoid. For those looking to sharpen their skills, consider using a well-structured forex trading profit Trading Platform QA to enhance your trading experience.

What is Forex Trading?

Forex trading, or foreign exchange trading, involves the buying and selling of currencies in the global marketplace. The goal is to profit from changes in currency values. It operates 24 hours a day across different time zones, making it one of the most accessible and liquid markets in the world. Traders can operate from anywhere, as long as they have internet access. The Forex market is influenced by various factors such as economic indicators, geopolitical events, and market sentiment.

The Basics of Forex Trading Profit

Profit in Forex trading can be achieved through appreciation (or depreciation) of currency pairs. When a trader believes that a currency will strengthen against another, they buy the currency pair (this is known as ‘going long’). Conversely, if they anticipate that a currency will weaken, they sell the currency pair (known as ‘going short’). The difference in price when the trader closes their position determines their profit or loss.

Understanding Pips and Leverage

The term ‘pip’ stands for “percentage in point,” and it is the smallest price move that a given exchange rate can make based on market convention. For most currency pairs, a pip is a movement in the fourth decimal place (0.0001). Understanding how pips work is crucial, as the profit or loss is often calculated based on the number of pips gained or lost.

Leverage is another critical aspect of Forex trading profit. It allows traders to control a larger position than they could with their available capital. While leverage can amplify gains, it can also magnify losses, making it a double-edged sword. Therefore, it is vital to understand your risk tolerance before employing leverage in your trading strategy.

Strategies for Maximizing Forex Trading Profit

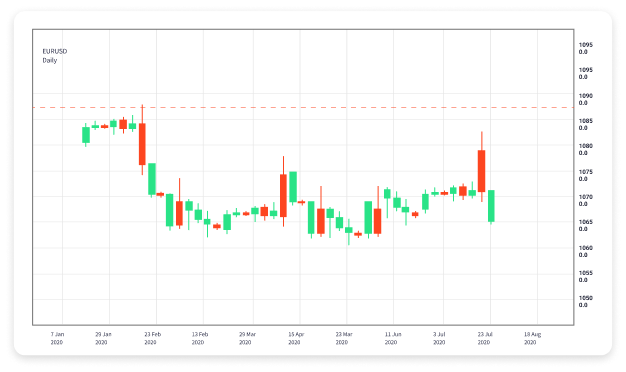

1. Technical Analysis

Technical analysis involves studying price charts and using indicators to predict future price movements. Traders use various tools, such as moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels, to identify entry and exit points. Mastering technical analysis can significantly improve your trading accuracy and profit potential.

2. Fundamental Analysis

Fundamental analysis focuses on economic indicators, financial news, and geopolitical events that may influence currency values. Traders analyze economic reports, interest rates, inflation, and employment data to gauge the health of a country’s economy. Keeping abreast of global news events can provide insights that lead to profitable trades.

3. Risk Management

Effective risk management is essential for long-term profitability in Forex trading. Setting stop-loss and take-profit orders can help manage potential losses and lock in profits. A common rule is to risk only a small percentage of your trading capital on any single trade. This approach ensures that even a series of losing trades won’t significantly impact your overall capital.

4. Developing a Trading Plan

A well-defined trading plan serves as a roadmap for your trading activities. It should outline your trading goals, strategies, risk tolerance, and rules for entering and exiting trades. Sticking to your trading plan, rather than making impulsive decisions based on market noise, can help keep your trading focused and profitable.

Common Pitfalls to Avoid

1. Overleveraging

While leverage can enhance profits, overleveraging increases exposure to risk. Traders often fall into the trap of using excessive leverage, leading to significant losses. It is crucial to use leverage responsibly and within the bounds of your risk management strategy.

2. Emotional Trading

Letting emotions drive trading decisions is one of the biggest pitfalls Forex traders face. Fear and greed can lead to impulsive actions, such as overtrading or holding on to losing positions for too long. Developing emotional discipline is vital for maintaining a consistent trading approach.

3. Lack of Education

Forex trading is complex and requires continuous learning. Many beginners enter the market without fully understanding how it operates, leading to costly mistakes. Investing time in education, whether through books, online courses, or demo accounts, is crucial to becoming a successful Forex trader.

Conclusion

Forex trading profit is achievable with the right knowledge, strategies, and mindset. By understanding the basics of currency trading, employing effective strategies, managing risks, and avoiding common pitfalls, traders can enhance their chances of long-term success. Remember to continually educate yourself, adapt to changing market conditions, and refine your trading strategies. With patience and persistence, you can navigate the exciting world of Forex trading and work toward unlocking the full potential of your trading profits.