Mastering Forex Trading with Demo Accounts

For those who are new to Forex trading, understanding the mechanics and nuances of the market can be a challenging task. One effective way to navigate this complexity is through demo forex trading Best Argentine Brokers demo trading accounts. These platforms allow new traders to practice without the risk of losing real money while familiarizing themselves with the trading environment, charting, and analysis techniques.

What is Demo Forex Trading?

Demo Forex trading refers to the use of a simulated trading environment where traders can practice trading without financial risk. It offers the same features as a live trading account but uses virtual funds instead of real money. This allows traders to execute trades, test strategies, and understand how the Forex market operates while building their confidence and skills.

Benefits of Using a Demo Account

1. Risk-Free Learning Environment

One of the primary advantages of demo accounts is the risk-free aspect. Traders can experiment with different trading strategies, tools, and techniques without the fear of losing their hard-earned money. This is particularly beneficial for beginners who need to familiarize themselves with the basics of Forex trading.

2. Strategy Development

Demo trading provides a platform for traders to develop and refine their trading strategies. By testing various approaches, traders can identify what works best for them and what doesn’t, thereby tailoring their trading style to fit their individual needs without any financial repercussions.

3. Platform Familiarization

Each Forex broker offers different trading platforms, and it is crucial for traders to be comfortable using the tools provided. A demo account enables new traders to familiarize themselves with the trading interface, charts, and analytics tools before engaging in live trading.

4. Understanding Market Dynamics

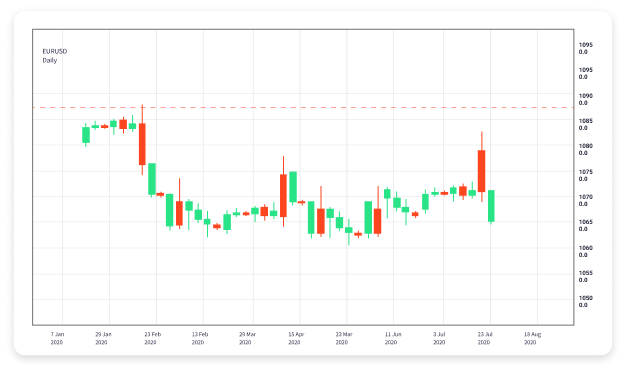

Demo accounts allow traders to observe real-time market conditions. They can practice how to react to market movements, understand economic indicators, and learn to read charts and trading signals all while not risking any actual capital.

How to Effectively Use a Demo Account

1. Treat It Like a Real Account

Many traders make the mistake of treating demo accounts lightly because they are not using real money. However, for effective learning, it is essential to treat the demo account as if it were real. This mindset will help develop discipline in managing trades and adhering to trading plans.

2. Set Clear Goals

When starting with a demo account, it’s important to set specific, measurable goals. For instance, aiming for a certain percentage return over a month can help in tracking progress and maintaining focus.

3. Keep a Trading Journal

Maintaining a trading journal can be an invaluable practice. By logging trades, analyzing their outcomes, and reflecting on what strategies worked or didn’t, traders can learn systematically and improve their performance over time.

4. Experiment with Various Strategies

Different trading strategies can yield varying results depending on market conditions. Demo accounts are the perfect place to try out multiple approaches – whether it’s scalping, swing trading, or trend-following – to determine which aligns best with the trader’s preferences.

Common Pitfalls to Avoid

1. Underestimating the Importance of Demo Trading

Some traders may skip demo trading altogether, thinking they can jump straight into live trading. This can lead to unnecessary losses in the initial stages. Taking the time to understand and practice is crucial.

2. Over-Trading

Since there is no risk involved, traders sometimes find themselves over-trading. Limit the number of trades per day and focus on quality rather than quantity to develop sound trading habits.

3. Ignoring Emotions

Demo trading does not evoke the same emotional responses as live trading does. However, it’s vital to be aware of emotional decision-making when transitioning to real accounts. Developing a strong psychological approach to trading is important.

Transitioning to Live Trading

Once a trader feels confident and has developed a robust trading strategy through a demo account, it is time to transition to live trading. However, it is wise to start small, using only a portion of available funds, to ease into the new environment while still being cautious with risk management.

Conclusion

Demo Forex trading is an invaluable tool for both new and seasoned traders. By providing a risk-free environment to practice, develop strategies, and learn market behaviors, traders can build a solid foundation before entering the potentially volatile real-money markets. Remember to take the lessons learned in demo trading seriously, as they can significantly enhance your chances of success in live trading. With dedication, practice, and proper risk management, traders can confidently navigate the world of Forex and achieve their trading goals.