When a liked one passes away, households typically bother with investing months and even years overcoming probate proceedings. The thought of lawful fees, court looks, and paperwork can really feel daunting during an already difficult time. Nevertheless, The golden state regulation gives less complex alternatives for even more moderate estates that reduce both time and expenditure.

The Small estate sworn statement technique offers a practical alternative to full probate administration, and a simplified probate process can be extra cost-effective in specific conditions. San Diego probate lawyer Mark Ignacio helps family members comprehend when these customized treatments apply and just how to use them efficiently. Instead of dealing with prolonged court procedures, eligible families can typically move possessions and work out affairs within weeks as opposed to months.

What Qualifies as a Small Estate in The Golden State

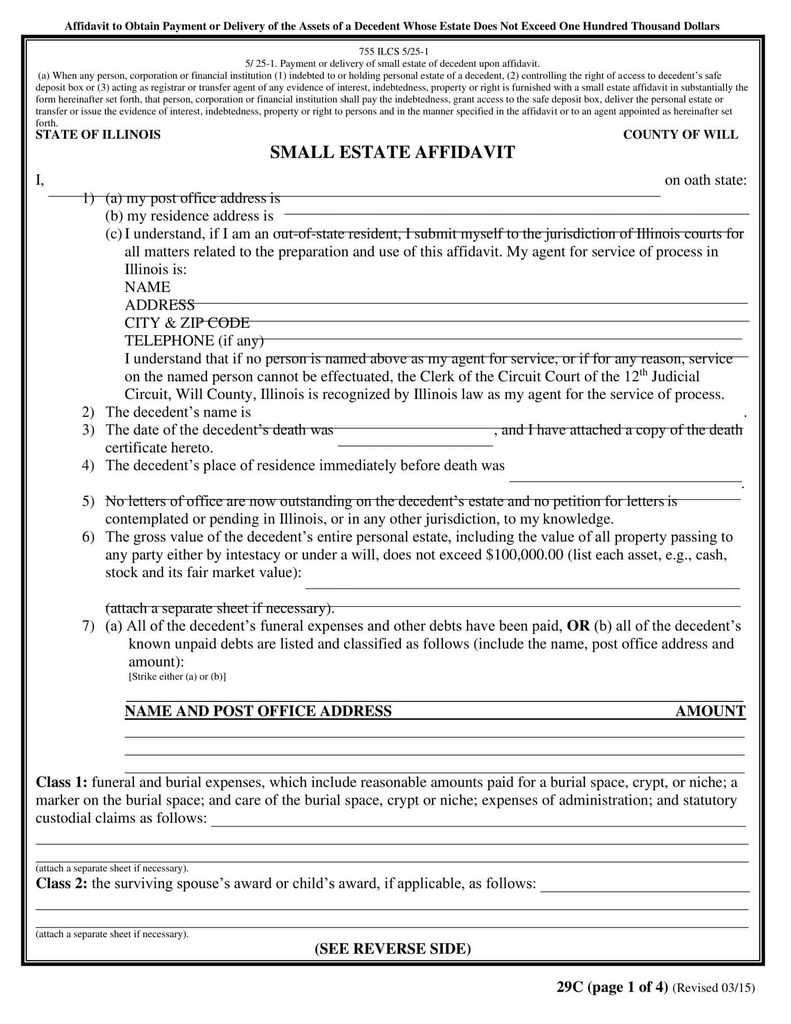

The golden state law defines Small estates based upon particular dollar thresholds, which are adjusted every 3 years for rising cost of living.Я прочитал статью об этом Montana Affidavit of Small Estate Из нашей статьи According to the 2025 California Courts Self-Help Guide:

- For fatalities prior to April 1, 2022: $166,250

- For fatalities in between April 1, 2022, and March 31, 2025: $184,500

- For deaths on or after April 1, 2025: $208,850

These limits put on the gross value of the decedent’s estate, leaving out certain possessions such as:

- Possessions kept in joint occupancy

- Properties with marked recipients (e.g., life insurance, pension)

- Properties kept in a living count on

- Real estate outside of The golden state

How the Small Estate Testimony Process Works

The Small estate affidavit provides a structured approach for moving assets, offering a sensible example of exactly how to prevent expensive probate conflicts. California courts need waiting at the very least 40 days after a person’s fatality prior to beginning property transfers. This waiting duration assists protect lenders’ legal rights and stays clear of hurried decisions throughout the preliminary mourning period, further minimizing the capacity for lawful conflict.

Qualified followers can prepare and authorize vouched affidavits specifying their right to receive details assets. These testimonies must include thorough info about:

- The departed person’s info. This consists of complete name, day of death, and last well-known address to appropriately recognize the estate.

- Possession descriptions. Synopsis particular details about each possession being asserted, consisting of account numbers and approximated values.

- Lawful entitlement. Supply a clear explanation of why the individual authorizing the testimony deserves to obtain the assets.

- Estate value statement. This is a vouched declaration that the total estate value falls listed below the certifying threshold.

Now, it is essential to bear in mind that banks, investment companies, and other financial institutions assess these sworn statements together with sustaining paperwork such as fatality certificates and identification. A lot of establishments have actually developed procedures for small estate transfers, though handling times and needs differ.

The The Golden State Department of Motor Automobiles adheres to similar sworn statement treatments for lorry transfers but has its own forms and demands. Personal property transfers typically occur informally amongst relative, however important products may call for documents for insurance or tax obligation purposes.

When Simplified Probate Makes Good Sense

Also holdings that surpass Small estate thresholds might qualify for California’s simplified probate treatments in certain conditions. These procedures, while still calling for court participation, reduce several typical probate requirements.

Deciding between Small estate sworn statements and simplified probate commonly depends upon asset complexity rather than simply total worth. San Diego probate lawyer Mark Ignacio might advise streamlined probate when:

- Numerous asset types exist. Estates with various bank accounts, financial investment accounts, and business interests may take advantage of court guidance.

- Family members disagreements develop. When beneficiaries disagree concerning possession distribution, court oversight supplies legal defense.

- Financial institution issues exist. If potential creditor claims need resolution, official procedures provide better protection.

- Realty complications occur. Feature in several states or with uncertain titles might require court involvement.

Some possessions require court participation no matter estate dimension. For example, if the departed possessed real estate in several states or had pending lawsuit cases, official probate procedures might be required also for otherwise Small estates.

Why San Diego Estate Preparation With Mark Ignacio Regulation Still Issues for Small Estates

Many individuals assume that modest holdings intended for beneficiary circulation don’t need breakthrough preparation since streamlined procedures are offered. However, proper estate preparation can make even small estate management a lot easier for enduring member of the family.

A properly composed will clarifies your regulations – also those that include your charitable and religions – and gives legal authority for property circulation. Without a will, California’s intestacy legislations determine that acquires what, which may not match your actual dreams.

Trust-based estate plans aid households stay clear of probate entirely, regardless of estate size. Revocable living counts on permit property transfers without court participation or waiting periods. For San Diego households taking care of useful property, trusts offer particular benefits considering that California realty worths commonly press estates over Small estate limits.