Understanding CFD Forex Trading: Strategies, Benefits, and Risks

Contract for Difference (CFD) trading has gained immense popularity among investors due to its unique advantages in the Forex market. With the ability to leverage small investments into substantial positions, CFD Forex trading allows traders to capitalize on price movements without actually owning the underlying asset. In this comprehensive guide, we will explore the fundamentals of CFD Forex trading, discuss various strategies, outline the benefits and risks involved, and provide insights on how to choose the right broker, such as cfd forex trading Trading Broker SA.

What is CFD Forex Trading?

CFD stands for Contract for Difference, which is a financial derivative that enables traders to speculate on the rising or falling prices of currency pairs in the Forex market. Unlike traditional Forex trading, where you own the actual currency, CFD trading involves an agreement between the trader and the broker to exchange the difference in the asset’s price from when the contract is opened to when it is closed.

How CFD Trading Works

In CFD Forex trading, the trader enters into a contract with a broker. This contract reflects the difference between the opening and closing price of a currency pair. If the market moves in the trader’s favor, they can close the contract at a profit. Conversely, if the market moves against the trader, they could incur losses. The beauty of CFD trading lies in its flexibility—traders can go long (buy) if they expect a price increase or go short (sell) if they anticipate a decrease.

Advantages of CFD Forex Trading

The popularity of CFD Forex trading can be attributed to several key advantages:

- Leverage: CFD trading allows traders to wield significant leverage, meaning they can control a larger position with a smaller amount of capital. While this can amplify profits, it also magnifies losses.

- Access to Diverse Markets: Through CFDs, traders can gain exposure to various markets beyond traditional Forex pairs, including commodities, indices, and stocks.

- No Ownership of Assets: Since traders do not own the underlying asset, they are free from issues such as storage and dividend payments.

- Short Selling Capability: CFDs enable traders to profit from both rising and falling markets through short selling.

- Flexibility: CFD contracts can be traded at any time during market hours, providing greater flexibility and options for traders.

Risks of CFD Forex Trading

While CFD Forex trading comes with various benefits, it is essential to understand the risks involved:

- Leverage Risk: High leverage can lead to substantial losses that exceed initial deposits. Traders must manage leverage wisely to avoid account depletion.

- Market Volatility: The Forex market is known for its volatility. Sudden price movements can result in significant gains or losses, making it crucial for traders to stay informed and prepared.

- Broker Dependency: The success of CFD trading relies heavily on the broker chosen. A reputable broker can facilitate seamless trades, while a dubious one may impede trading or lead to losses.

- Emotional Trading: The fast-paced nature of CFD trading can lead to emotional decision-making, which can harm a trader’s overall strategy.

Developing Successful CFD Forex Trading Strategies

To thrive in CFD Forex trading, it is crucial to develop effective trading strategies. Here are some popular strategies employed by successful traders:

- Technical Analysis: Traders use charts and technical indicators to analyze price movements and identify potential entry and exit points.

- Fundamental Analysis: Understanding economic indicators, news events, and market sentiment can help traders make informed decisions in alignment with economic trends.

- Risk Management: Effective risk management strategies, such as setting stop-loss and take-profit orders, are essential to safeguard capital and optimize profits.

- Scalping: This strategy involves making numerous short-term trades throughout the day to capitalize on small price fluctuations.

- Position Trading: This long-term strategy focuses on holding positions for an extended period, capitalizing on bigger market moves.

Choosing the Right CFD Forex Broker

The choice of a broker is a critical factor in CFD trading success. Here are some key aspects to consider when selecting a CFD Forex broker:

- Regulation: Ensure that the broker is regulated by a reputable authority. This adds a layer of security to your trading funds and guarantees fair practices.

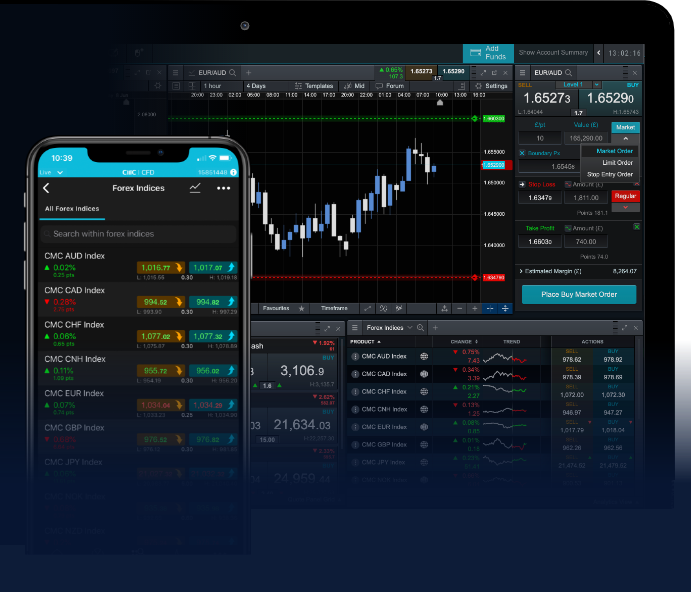

- Trading Platform: A user-friendly trading platform with reliable performance is vital for executing trades efficiently. Test the platform using demo accounts to assess its functionality.

- Fees and Spreads: Review the fee structure and spreads offered by the broker. Competitive fees are essential for maintaining profitability in trading.

- Customer Support: Having responsive customer support is essential, especially for new traders who may require assistance in navigating the complex world of Forex trading.

- Educational Resources: Many reputable brokers provide resources and tools for traders to improve their knowledge and skills. Look for those that offer informative webinars, articles, or tutorials.

Conclusion

CFD Forex trading is a compelling avenue for traders looking to engage with the foreign exchange market in a flexible manner. While it presents numerous opportunities for profit, it also requires a thorough understanding of trading strategies, effective risk management, and a careful selection of a broker. By taking the time to educate yourself and stay informed about market trends and dynamics, you can navigate the intriguing world of CFD Forex trading and work towards achieving your financial goals.