Understanding Forex Trading: Definition, Benefits, and Strategies

Forex trading, also known as foreign exchange trading, is a vast and intricate marketplace where currencies are bought and sold. This decentralized market operates around the clock and facilitates the global exchange of currencies. With a daily trading volume exceeding $6 trillion, Forex trading has become the world’s largest financial market. In this article, we will delve into the definition of Forex trading, its benefits, and useful strategies for both novice and experienced traders. For those looking for a reliable starting point, check out the forex trading definition Best Platforms for Trading.

What is Forex Trading?

At its core, Forex trading involves the exchange of one currency for another. Traders speculate on price movements in currency pairs to either profit from their fluctuations or hedge against risks in global markets. Unlike traditional stock markets, the Forex market is not tied to any specific exchange, allowing for continuous trading worldwide.

Currency pairs are always quoted as two currencies, where the first is the base currency and the second is the quote currency. For example, in the currency pair EUR/USD, the Euro is the base currency, while the US Dollar is the quote currency. Traders make a profit by buying a currency pair when they expect its value to increase, or selling it when they expect a decline.

Benefits of Forex Trading

The allure of Forex trading can be attributed to several advantages:

- High Liquidity: The Forex market is highly liquid, meaning that traders can execute large orders without causing significant price changes.

- Leverage: Forex trading often allows high leverage, enabling traders to control larger positions with a smaller amount of capital.

- Accessibility: The Forex market is easily accessible to retail traders via online platforms and brokers, making it easy for anyone to start trading.

- Diverse Opportunities: With a plethora of currency pairs to choose from, traders can explore various strategies and opportunities across different economies.

- 24-Hour Market: Forex trading practitioners can trade at any time of day, thus offering flexibility for those balancing other commitments.

Key Concepts in Forex Trading

To navigate the Forex market effectively, traders should be familiar with several key concepts:

Currency Pairs

As previously mentioned, currencies are traded in pairs. This implies that when you buy one currency, you’re simultaneously selling another. Understanding the various types of currency pairs is essential:

- Major Pairs: These pairs involve the most traded currencies globally, such as EUR/USD, USD/JPY, and GBP/USD.

- Minor Pairs: These pairs do not involve the US Dollar and may include currencies like EUR/GBP or AUD/NZD.

- Exotic Pairs: These consist of a major currency paired with a currency from a developing economy, like USD/TRY (Turkish Lira).

Pips and Spreads

A pip or “percentage in point” is the smallest price movement in the Forex market. Typically, it refers to a change in the fourth decimal point of a currency pair’s price. The spread, on the other hand, is the difference between the bid price (the price you can sell at) and the ask price (the price you can buy at). Understanding these concepts helps traders gauge their potential profits and losses.

Forex Trading Strategies

Traders can adopt various strategies based on their goals and risk tolerance. Here are some common approaches:

Day Trading

Day trading involves buying and selling currencies within the same trading day. Traders who employ this strategy aim to profit from short-term price movements and often make multiple trades throughout the day.

Swing Trading

Swing trading capitalizes on price “swings” in the market. Traders typically hold positions for several days or weeks to profit from expected price changes. This approach allows for less stress compared to day trading while still taking advantage of market fluctuations.

Scalping

Scalping is a high-frequency trading strategy where traders aim to make small profits from a large number of trades. This method requires a keen understanding of market movements and solid technical analysis skills.

Position Trading

Position trading takes a longer-term approach, where traders hold positions for weeks, months, or even years. This strategy is typically based on fundamental analysis and broader economic trends.

Risk Management in Forex Trading

While Forex trading offers substantial opportunities for profit, it also involves significant risks. Effective risk management is crucial for maintaining a balanced trading portfolio. Here are a few key principles:

- Use Stop-Loss Orders: Implementing stop-loss orders can help limit potential losses by automatically closing a position at a predetermined price.

- Calculate Position Size: Understanding how much to invest based on your overall trading capital is essential for managing risk.

- Diversify Your Trades: Avoid putting all your capital into one trade or currency pair to reduce risk and improve long-term trading health.

Choosing a Forex Broker

Choosing the right Forex broker is a critical step in your trading journey. Factors to consider when selecting a broker include:

- Regulation: Ensure the broker is regulated by relevant authorities to maintain a secure trading environment.

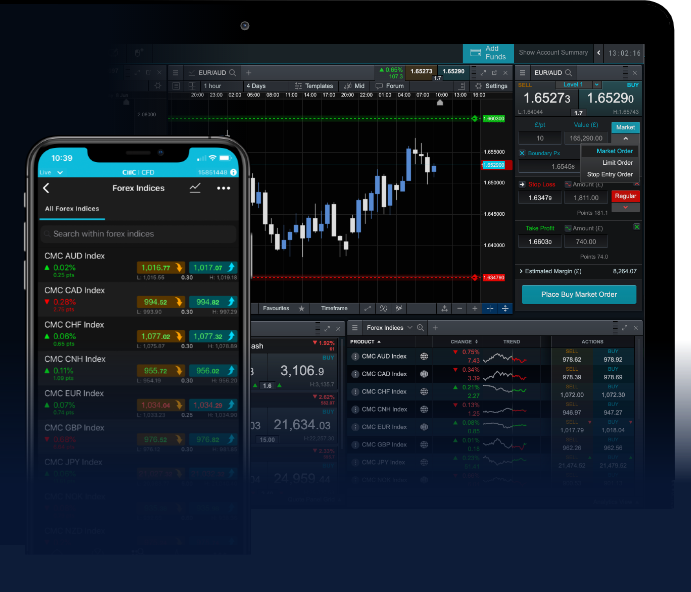

- Trading Platforms: Evaluate the trading platform’s features, user-friendliness, and execution speeds.

- Spreads and Fees: Compare the spreads and fees among different brokers to find a cost-effective option.

- Customer Support: Effective customer service can help resolve issues promptly.

Conclusion

In conclusion, Forex trading represents a unique opportunity for traders to engage in a dynamic marketplace where currencies are constantly being exchanged. By understanding its definition, benefits, and key concepts, traders can develop effective strategies and navigate the complexities of the Forex market. Remember that successful trading requires continual education, discipline, and a solid risk management strategy. Whether you’re a beginner or a seasoned trader, there is always something new to learn in the fascinating world of Forex trading.